HDFC Bank Ltd

NSE :HDFCBANK BSE :500180 Sector : BanksBuy, Sell or Hold HDFCBANK? Ask The Analyst

BSE

Apr 22, 00:00

1961.90

34.35 (1.78%)

prev close

1927.55

OPEN PRICE

1940.00

volume

890620

Today's low / high

1935.20 / 1970.65

52 WK low / high

1430.15 / 1970.65

bid price (qty)

0 (0)

offer price (qty)

0 (0)

NSE

prev close

open price

volume

Today's' low / high

52 WK low / high

bid price (qty)

offer price (qty)

| 22 Apr 1961.70 (1.80%) | 21 Apr 1927.10 (1.07%) | 17 Apr 1906.70 (1.53%) | 16 Apr 1878.00 (0.70%) | 15 Apr 1864.90 (3.22%) | 11 Apr 1806.75 (2.37%) | 09 Apr 1765.00 (-0.23%) | 08 Apr 1769.15 (0.65%) | 07 Apr 1757.70 (-3.28%) | 04 Apr 1817.30 (1.25%) | 03 Apr 1794.85 (-0.11%) | 02 Apr 1796.90 (1.64%) | 01 Apr 1767.85 (-3.30%) | 28 Mar 1828.20 (0.16%) | 27 Mar 1825.35 (1.04%) | 26 Mar 1806.55 (-0.82%) | 25 Mar 1821.45 (1.19%) | 24 Mar 1800.00 (1.67%) | 21 Mar 1770.35 (0.09%) | 20 Mar 1768.75 (1.41%) | 19 Mar 1744.10 (0.69%) |

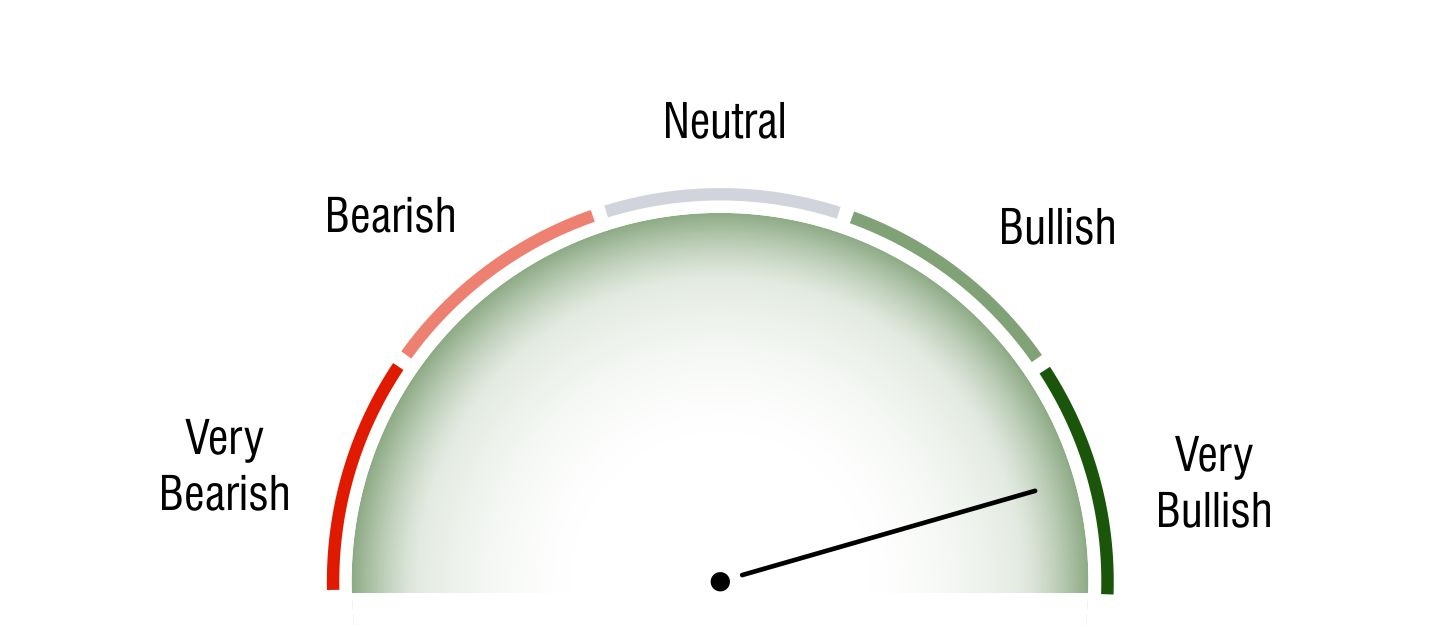

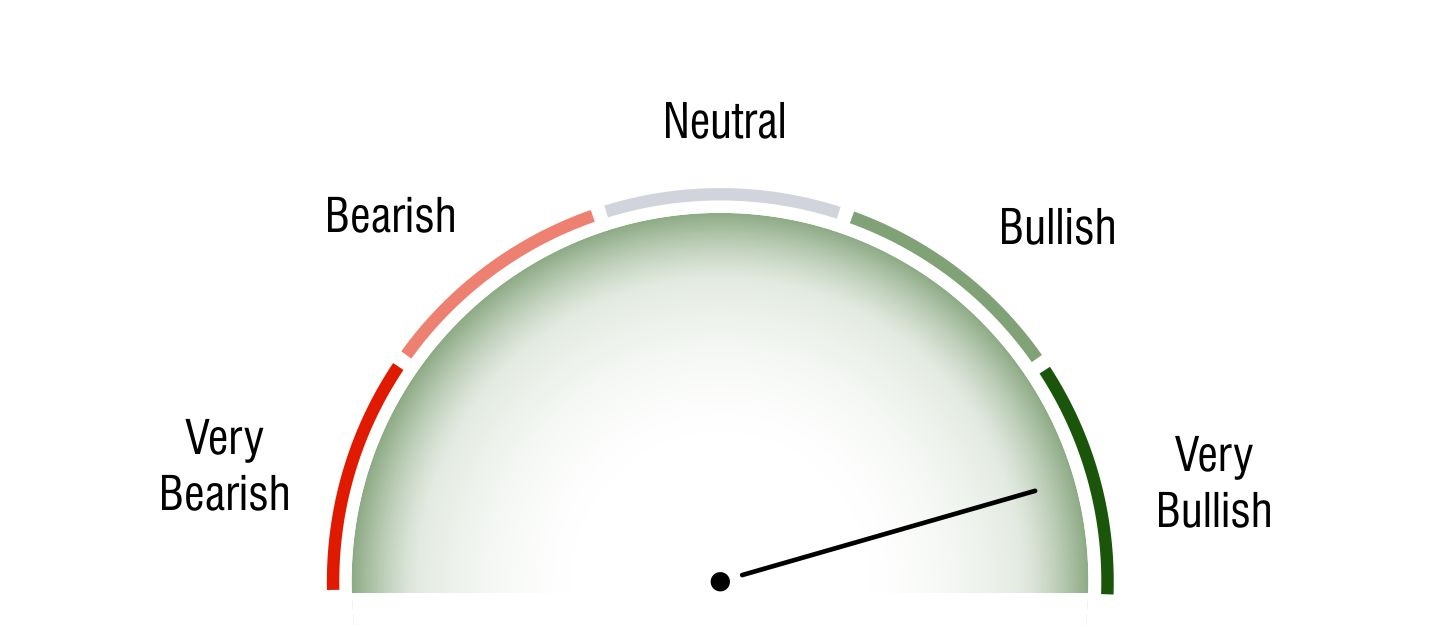

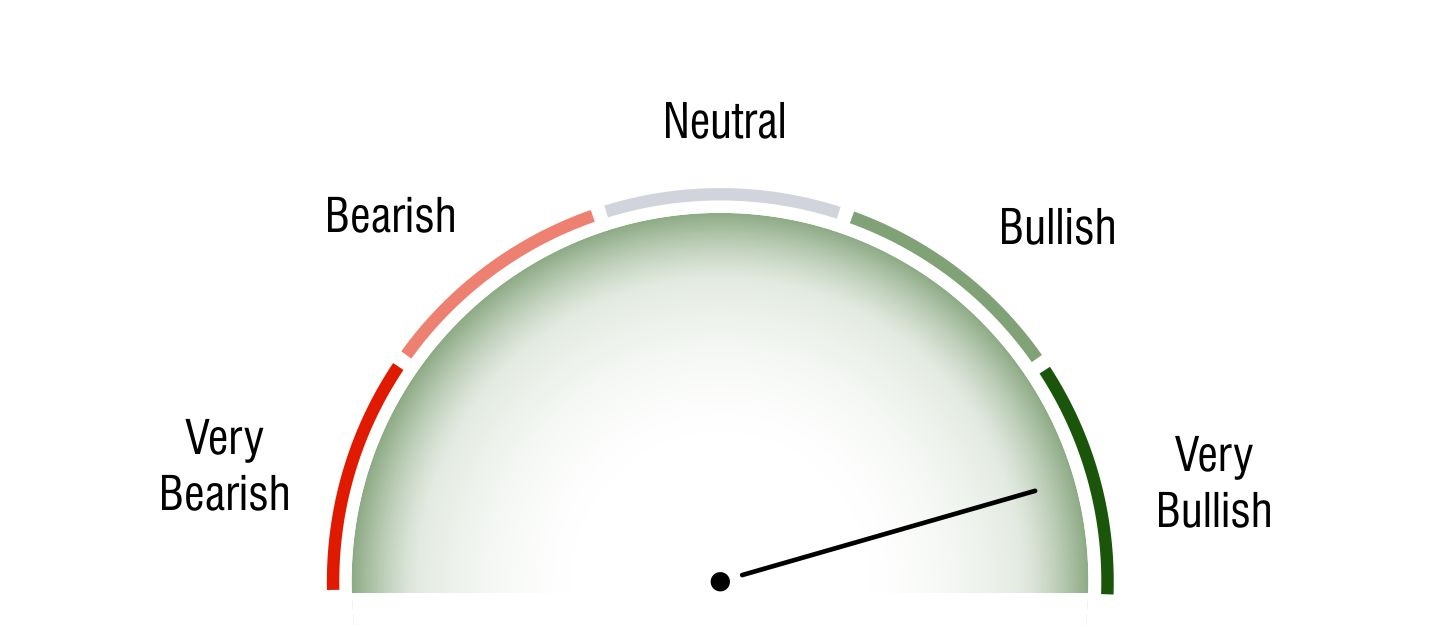

Technical Analysis

Short Term Investors

Very Bullish

Medium Term Investors

Very Bullish

Long Term Investors

Very Bullish

Moving Averages

5 DMA

Bullish

1907.76

10 DMA

Bullish

1845.52

20 DMA

Bullish

1821.65

50 DMA

Bullish

1753.54

100 DMA

Bullish

1752.08

200 DMA

Bullish

1714

Intraday Support and Resistance

(Based on Pivot Points) undefined | BSE : 1961.90

Updated On Apr 22, 2025 04:00 PM For Next Trading Session

| Pivots | Classic | Fibonacci | Camarilla | Woodie | DM |

|---|---|---|---|---|---|

| R3 | 2012.14 | 1991.37 | 1971.49 | - | - |

| R2 | 1991.37 | 1977.77 | 1968.23 | 1992.85 | - |

| R1 | 1976.54 | 1969.37 | 1964.96 | 1979.5 | 1983.95 |

| P | 1955.77 | 1955.77 | 1955.77 | 1957.25 | 1959.48 |

| S1 | 1940.94 | 1942.17 | 1958.44 | 1943.9 | 1948.35 |

| S2 | 1920.17 | 1933.77 | 1955.17 | 1921.65 | - |

| S3 | 1905.34 | 1920.17 | 1951.91 | - | - |

Key Metrics

EPS

88.01

P/E

22.29

P/B

3.02

Dividend Yield

1.12%

Market Cap

15,01,136 Cr.

Face Value

1

Book Value

650.29

ROE

17.55%

EBITDA Growth

72,558.6 Cr.

Debt/Equity

0

Shareholding History

Quarterly Result (Figures in Rs. Crores)

HDFC Bank Ltd Quaterly Results

| Mar 2024 | Jun 2024 | Sep 2024 | Dec 2024 | Mar 2025 | ||

| INCOME | 124391.35 | 116996.49 | 121456.74 | 112193.94 | 120268.76 | |

| PROFIT | 17622.38 | 16474.85 | 17825.91 | 17656.61 | 18834.88 | |

| EPS | 23.2 | 21.67 | 23.4 | 23.11 | 24.62 |

HDFC Bank Ltd Quaterly Results

| Mar 2024 | Jun 2024 | Sep 2024 | Dec 2024 | Mar 2025 | ||

| INCOME | 89639 | 83701.25 | 85499.64 | 87460.44 | 89487.99 | |

| PROFIT | 16511.85 | 16174.75 | 16820.97 | 16735.5 | 17616.14 | |

| EPS | 21.74 | 21.28 | 22.08 | 21.9 | 23.03 |

Profit & Loss (Figures in Rs. Crores)

HDFC Bank Ltd Profit & Loss

| Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | ||

| INCOME | 60212.17 | 74373.21 | 86176.43 | 101344.44 | 124107.79 | 147068.26 | 155885.28 | 167695.4 | 204666.1 | 407994.77 | |

| PROFIT | 10681.56 | 12801.41 | 15254.07 | 18510.75 | 22311.92 | 27235.43 | 31800.06 | 38001.91 | 45927.26 | 63898.6 | |

| EPS | 21.35 | 25.35 | 29.88 | 35.76 | 41.21 | 49.78 | 57.79 | 68.8 | 82.71 | 86.15 |

HDFC Bank Ltd Profit & Loss

| Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | ||

| INCOME | 57466.25 | 70973.17 | 81602.46 | 95461.66 | 116597.93 | 138073.47 | 146063.12 | 157263.02 | 192800.37 | 307581.58 | |

| PROFIT | 10208.55 | 12296.21 | 14549.64 | 17486.73 | 21078.17 | 26257.32 | 31116.53 | 36961.36 | 44108.7 | 60812.28 | |

| EPS | 19.57 | 24.32 | 28.39 | 33.69 | 38.7 | 47.89 | 56.44 | 66.65 | 79.05 | 80.05 |

Balance Sheet (Figures in Rs. Crores)

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | |

| SOURCES OF FUNDS : | ||||||||||

| Capital | 759.69 | 557.97 | 554.55 | 551.28 | 548.33 | 544.66 | 519.02 | 512.51 | 505.64 | 501.3 |

| Reserves Total | 4,55,635.56 | 2,88,879.53 | 2,46,771.62 | 2,09,258.9 | 1,75,810.38 | 1,53,128 | 1,09,080.11 | 91,281.44 | 73,798.49 | 62,652.77 |

| Minority Interest | 13,383.4 | 860.26 | 720.41 | 632.76 | 576.64 | 501.79 | 356.33 | 291.44 | 180.62 | 161.63 |

| Deposits | 23,76,887.28 | 18,82,663.25 | 15,58,003.03 | 13,33,720.87 | 11,46,207.13 | 9,22,502.68 | 7,88,375.14 | 6,43,134.25 | 5,45,873.29 | 4,50,283.65 |

| Borrowings | 7,30,615.46 | 2,56,548.66 | 2,26,966.5 | 1,77,696.75 | 1,86,834.32 | 1,57,732.78 | 1,56,442.08 | 98,415.64 | 1,03,713.96 | 59,478.25 |

| Other Liabilities & Provisions | 1,80,464.33 | 1,00,922.77 | 89,918.19 | 77,646.07 | 70,853.63 | 58,395.8 | 48,460.09 | 58,827.4 | 38,234.85 | 34,091.28 |

| Policy Holders Fund | 2,78,080.8 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| TOTAL LIABILITIES | 40,35,826.52 | 25,30,432.44 | 21,22,934.3 | 17,99,506.63 | 15,80,830.43 | 12,92,805.71 | 11,03,232.77 | 8,92,462.68 | 7,62,306.85 | 6,07,168.88 |

| APPLICATION OF FUNDS : | ||||||||||

| Cash & Balances with RBI | 1,78,718.67 | 1,17,189.28 | 1,30,030.71 | 97,370.35 | 72,211 | 46,804.59 | 1,04,688.2 | 37,910.55 | 30,076.58 | 27,522.29 |

| Balances with Banks & money at Call | 50,115.84 | 79,958.53 | 25,355.02 | 23,902.16 | 15,729.11 | 35,013.05 | 18,373.35 | 11,400.57 | 8,992.3 | 9,004.13 |

| Investments | 10,05,681.63 | 5,11,581.71 | 4,49,263.86 | 4,38,823.11 | 3,89,304.95 | 2,89,445.87 | 2,38,460.92 | 2,10,777.11 | 1,93,633.85 | 1,49,454.42 |

| Advances | 25,65,891.41 | 16,61,949.29 | 14,20,942.28 | 11,85,283.52 | 10,43,670.88 | 8,69,222.66 | 7,00,033.84 | 5,85,480.99 | 4,87,290.42 | 3,83,407.97 |

| Fixed Assets | 12,603.76 | 8,431.35 | 6,432.07 | 5,248.35 | 4,775.65 | 4,368.63 | 4,008.13 | 3,999.7 | 3,666.86 | 3,224.94 |

| Other Assets | 2,22,815.21 | 1,51,322.28 | 90,910.36 | 48,879.14 | 55,138.85 | 47,950.9 | 37,668.32 | 42,893.76 | 38,646.84 | 34,555.11 |

| TOTAL ASSETS | 40,35,826.52 | 25,30,432.44 | 21,22,934.3 | 17,99,506.63 | 15,80,830.44 | 12,92,805.7 | 11,03,232.76 | 8,92,462.68 | 7,62,306.85 | 6,07,168.86 |

| Contingent Liabilities | 23,44,487.73 | 17,50,953.81 | 14,00,197.64 | 9,75,280.66 | 11,30,474.06 | 10,25,125.31 | 8,75,776.96 | 8,18,284.28 | 8,53,527.38 | 9,75,278.59 |

| Bills for collection | 65,332.87 | 71,439.54 | 56,968.05 | 44,748.14 | 51,584.9 | 49,952.8 | 42,753.83 | 30,848.04 | 23,490 | 22,304.93 |

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | |

| SOURCES OF FUNDS : | ||||||||||

| Capital | 759.69 | 557.97 | 554.55 | 551.28 | 548.33 | 544.66 | 519.02 | 512.51 | 505.64 | 501.3 |

| Reserves Total | 4,39,486.11 | 2,79,641.03 | 2,39,538.38 | 2,03,169.55 | 1,70,437.7 | 1,48,661.69 | 1,05,775.98 | 88,949.84 | 72,172.13 | 61,508.12 |

| Deposits | 23,79,786.28 | 18,83,394.65 | 15,59,217.44 | 13,35,060.22 | 11,47,502.29 | 9,23,140.93 | 7,88,770.64 | 6,43,639.66 | 5,46,424.19 | 4,50,795.64 |

| Borrowings | 6,62,153.08 | 2,06,765.57 | 1,84,817.21 | 1,35,487.32 | 1,44,628.54 | 1,17,085.12 | 1,23,104.97 | 74,028.87 | 84,968.98 | 45,213.56 |

| Other Liabilities & Provisions | 1,41,040.3 | 95,722.25 | 84,407.46 | 72,602.15 | 67,394.4 | 55,108.29 | 45,817.45 | 56,830.8 | 36,818.98 | 32,557.39 |

| Total Liabilities | 36,23,225.46 | 24,66,081.47 | 20,68,535.04 | 17,46,870.52 | 15,30,511.26 | 12,44,540.69 | 10,63,988.06 | 8,63,961.68 | 7,40,889.92 | 5,90,576.01 |

| APPLICATION OF FUNDS : | ||||||||||

| Cash & Balances with RBI | 1,78,683.22 | 1,17,160.77 | 1,29,995.64 | 97,340.73 | 72,205.12 | 46,763.62 | 1,04,670.47 | 37,896.87 | 30,058.31 | 27,510.45 |

| Balances with Banks & money at Call | 40,464.2 | 76,604.31 | 22,331.29 | 22,129.66 | 14,413.6 | 34,584.02 | 18,244.61 | 11,055.22 | 8,860.53 | 8,821 |

| Investments | 7,02,414.96 | 5,17,001.43 | 4,55,535.69 | 4,43,728.29 | 3,91,826.66 | 2,93,116.07 | 2,42,200.24 | 2,14,463.34 | 1,95,836.28 | 1,51,641.75 |

| Advances | 24,84,861.52 | 16,00,585.9 | 13,68,820.93 | 11,32,836.63 | 9,93,702.88 | 8,19,401.22 | 6,58,333.09 | 5,54,568.2 | 4,64,593.96 | 3,65,495.03 |

| Fixed Assets | 11,398.99 | 8,016.54 | 6,083.67 | 4,909.32 | 4,431.92 | 4,030 | 3,607.2 | 3,626.74 | 3,343.16 | 3,121.73 |

| Other Assets | 2,05,402.57 | 1,46,712.52 | 85,767.83 | 45,925.89 | 53,931.09 | 46,645.76 | 36,932.43 | 42,351.3 | 38,197.69 | 33,986.03 |

| Total Assets | 36,23,225.46 | 24,66,081.47 | 20,68,535.05 | 17,46,870.52 | 15,30,511.27 | 12,44,540.69 | 10,63,988.04 | 8,63,961.67 | 7,40,889.93 | 5,90,575.99 |

| Contingent Liabilities | 22,96,758.34 | 17,48,130.32 | 13,95,442.3 | 9,71,097.6 | 11,28,953.41 | 10,24,715.12 | 8,75,488.22 | 8,17,869.58 | 8,53,318.11 | 9,75,233.95 |

| Bills for collection | 65,332.87 | 71,439.54 | 56,968.05 | 44,748.14 | 51,584.9 | 49,952.8 | 42,753.83 | 30,848.04 | 23,490 | 22,304.93 |

Cash Flow (Figures in Rs. Crores)

| Net Profit before Tax and Extr... | 75,184.14 |

| Depreciation | 3,092.08 |

| P/L on Sales of Assets | -75.36 |

| P/L on Sales of Invest | -14,298.56 |

| Prov. and W/O (Net) | 27,716.1 |

| Others | 4,394.47 |

| Total Adjustments (PBT and Ext... | 16,434.26 |

| Operating Profit before Workin... | 91,618.4 |

| Loans and Advances | -3,09,210.7 |

| Investments | -88,411.63 |

| Change in Deposits | 3,36,964.81 |

| Total Adjustments (OP before W... | -49,706.22 |

| Cash Generated from/(used in) ... | 41,912.18 |

| Direct Taxes Paid | -22,842.84 |

| Total Adjustments(Cash Generat... | -22,842.84 |

| Cash Flow before Extraordinary... | 19,069.34 |

| Net Cash from Operating Activi... | 19,069.34 |

| Purchased of Fixed Assets | -4,286.72 |

| Sale of Fixed Assets | 99.82 |

| Sale of Investments | 9,500.67 |

| Net Cash used in Investing Act... | 16,600.42 |

| Proceeds from Issue of shares ... | 5,249.73 |

| Proceed from Issue of Debentur... | 2,350 |

| On Redemption of Debenture | -230 |

| Of the Long Tem Borrowings | -7,342.84 |

| Dividend Paid | -8,404.42 |

| Net Cash used in Financing Act... | -3,983.06 |

| Net Profit before Tax and Extr... | 70,895.31 |

| Depreciation | 2,810.1 |

| Dividend Received | 1,332.39 |

| P/L on Sales of Assets | -73.82 |

| P/L on Sales of Invest | -8,284.92 |

| Prov. and W/O (Net) | 25,884.5 |

| Others | 3,192.81 |

| Total Adjustments (PBT and Ext... | 19,003.47 |

| Operating Profit before Workin... | 89,898.78 |

| Loans and Advances | -2,89,444.22 |

| Investments | -54,833.62 |

| Change in Deposits | 3,39,132.41 |

| Total Adjustments (OP before W... | -35,040.07 |

| Cash Generated from/(used in) ... | 54,858.7 |

| Direct Taxes Paid | -19,843.74 |

| Total Adjustments(Cash Generat... | -19,843.74 |

| Cash Flow before Extraordinary... | 35,014.96 |

| Net Cash from Operating Activi... | 35,014.96 |

| Purchased of Fixed Assets | -3,834.89 |

| Sale of Fixed Assets | 96 |

| Sale of Investments | 9,500.67 |

| Net Cash used in Investing Act... | 12,604.31 |

| Proceeds from Issue of shares ... | 5,249.73 |

| Of the Long Tem Borrowings | -22,275.06 |

| Dividend Paid | -8,404.42 |

| Net Cash used in Financing Act... | -22,236.94 |

Company Details

Registered Office |

|

| Address | HDFC Bank House, Senapati BapatMarg Lower Parel |

| City | Mumbai |

| State | Maharashtra |

| Pin Code | 400013 |

| Tel. No. | 91-22-66521000/3976 0000 |

| Fax. No. | 91-22-24960737 |

| shareholder.grievances@hdfcbank.com | |

| Internet | http://www.hdfcbank.com |

Registrars |

|

| Address | HDFC Bank House |

| City | Mumbai |

| State | Maharashtra |

| Pin Code | 400013 |

| Tel. No. | 91-22-66521000/3976 0000 |

| Fax. No. | 91-22-24960737 |

| shareholder.grievances@hdfcbank.com | |

| Internet | http://www.hdfcbank.com |

Management |

|

| Name | Designation |

| Kaizad Bharucha | Deputy Managing Director |

| SANDEEP PAREKH | Independent Director |

| M D Ranganath | Independent Director |

| Renu S Karnad | Non Executive Director |

| Sashidhar Jagdishan | Managing Director & CEO |

| Sunita Maheshwari | Independent Director |

| Atanu Chakraborty | Part Time Chairman |

| Lily Vadera | Independent Director |

| Bhavesh Zaveri | Executive Director |

| K M Mistry | Non Executive Director |

| V Srinivasa Rangan | Whole Time Director |

| Harsh Kumar Bhanwala | Independent Director |

| AJAY GIRIDHARILAL AGARWAL | Company Sec. & Compli. Officer |

| Santhosh Iyengar Keshavan | Additional Director |